Are you a pet owner wondering if your beloved furry, feathered, or scaled companions could offer more than just unconditional love? The intersection of IRS regulations and pet-related expenses is a topic many taxpayers find fascinating yet confusing. This guide delves into the specifics, exploring when and how certain pet expenses might qualify for tax deductions, especially for service animals or those involved in income-generating activities. We'll navigate the often-misunderstood rules to help you identify potential savings and avoid common pitfalls, ensuring you're informed about the current landscape of pet-related tax implications. Understanding these nuances is crucial for any responsible pet owner looking to optimize their financial planning while providing the best for their animal friends. Staying updated on IRS and pets rules can truly make a difference in your financial planning.

Understanding IRS and Pets: Are Your Furry Friends Tax Deductible? Navigating Animal Expenses

Isn't it fascinating to think about whether our beloved furry, scaled, or feathered family members could actually impact our taxes? For many pet owners across the United States, the line between personal pet care and a potential tax deduction can seem incredibly blurry, or even non-existent. This comprehensive guide is here to shed light on how the Internal Revenue Service (IRS) actually views expenses related to animals, cutting through the confusion to reveal which pet-related costs might genuinely offer a tax benefit. We will explore who qualifies, what very specific conditions apply, and crucially, why a deep understanding of these rules isn't just about saving a few dollars, but about smart, informed financial planning for pet owners in 2026. Get ready to uncover opportunities you might have overlooked, all while ensuring you're playing by the rules when it comes to the IRS and pets.

The Curious Case of IRS and Pets: What Truly Qualifies?

We all dream of the day we can deduct every expense for our cherished companions, from that gourmet kibble to emergency vet visits and the mountain of squeaky toys. While the IRS generally views the costs of owning a typical companion animal as non-deductible personal expenses – much like your own groceries or clothing – there are indeed very specific, and sometimes surprising, situations where your animal friends can absolutely factor into your tax strategy. These vital exceptions primarily revolve around animals that serve a crucial medical purpose, actively participate in a recognized business activity, or contribute significantly to charitable efforts. Grasping these critical distinctions is more than just helpful; it is absolutely essential, as misunderstanding these nuanced rules could lead to unwelcome surprises during a tax audit. We're going to dive deep into each of these areas, offering crystal-clear guidance on the necessary documentation and the precise criteria the IRS uses to evaluate such claims, giving you a solid, unwavering foundation for any potential deductions. It's about seeing beyond the obvious love and finding the financial sense for IRS and pets.

Service Animals and IRS: A Medical Deduction for Your Essential Companions

When we talk about the IRS and pets, the most widely recognized and accepted area for deductions involves service animals. These extraordinary animals are far more than just companions; they are utterly indispensable aids for individuals living with disabilities, expertly performing specific, life-enhancing tasks that directly mitigate their owner's condition. The IRS thoughtfully considers the entire spectrum of costs associated with acquiring, training, and maintaining a certified service animal as entirely legitimate medical expenses. This expansive category includes virtually everything: their specialized food, essential grooming services, routine and emergency veterinary care, provided these expenses are unequivocally linked to the animal's critical function as a medical assistant. For example, if you rely on a highly trained guide dog, the unique dietary needs it has, its regular health check-ups, and even its advanced training costs can all be legitimately factored into your medical expense deductions. Crucially, maintaining meticulous, detailed records is absolutely paramount here, serving as unchallengeable proof of the animal's indispensable role and the direct necessity of every claimed expense. This important provision wisely acknowledges the profound and vital role these animals play in dramatically improving the quality of life for so many, impacting how we view IRS and pets.

Business Animals and IRS: When Your Pet Becomes Part of the Profit

Moving beyond the realm of service animals, there are compelling instances where animals become direct, active participants in a legitimate business endeavor, making their associated expenses entirely capable of being deducted. This intriguing category spans a wide array of scenarios, from vigilant guard dogs diligently protecting valuable business property to animals specifically utilized for professional breeding, competitive showing, or even as captivating performers in the entertainment industry. Consider, for example, if you operate a working farm and employ a highly skilled border collie for efficient livestock herding; in this case, its specialized food, crucial veterinary care, and ongoing training are all indisputably legitimate business expenses. Similarly, dedicated professional breeders or serious animal show competitors can confidently deduct a variety of costs directly related to their animals, as long as there is a clear, demonstrable profit motive underpinning their activities. Even savvy social media influencers who prominently feature their pets as an intrinsic, central component of their brand and content creation might discover that certain expenses are deductible, although this particular area demands careful navigation and an unequivocal demonstration of a clear business intent alongside consistent income generation. The absolute key here is providing irrefutable evidence that the animal plays an integral, active role in consistently generating taxable income for your enterprise, rather than simply being a beloved, albeit adorable, office mascot for IRS and pets.

Charitable Contributions and Foster Care: Giving Back to Animals with a Tax Benefit for IRS and Pets

For those incredibly generous souls who selflessly dedicate their time, energy, and financial resources to the noble cause of animal welfare, there can also be meaningful tax implications that reward their kindness. If you actively foster animals for a qualified 501(c)(3) charitable organization – a true act of compassion – certain unreimbursed out-of-pocket expenses you incur while lovingly caring for these animals may very well be deductible as charitable contributions. This can thoughtfully encompass a range of costs, including the expense of specialized food, essential medical supplies, and even the mileage accrued while transporting your foster animals to crucial veterinary appointments or exciting adoption events. Likewise, direct financial donations or contributions of valuable property to legitimate, recognized animal charities are generally, and thankfully, tax-deductible. It’s absolutely vital to remember that the organization must hold a recognized charitable status for these specific deductions to be applicable. While your primary motivation for such incredible acts is always profound compassion and a desire to help, understanding these potential tax benefits can certainly provide an additional, welcome incentive and crucial support for these vital programs, ultimately helping countless more animals find their secure, loving forever homes. Always, always keep meticulous receipts and comprehensive records of every single one of your out-of-pocket expenses for the IRS and pets.

Navigating the Nuances: Essential Tips for Smart IRS and Pets Claims

Grasping the potential deductions related to 'irs and pets' is a fantastic and empowering first step, but the actual process of effectively claiming them demands an unparalleled level of meticulous attention to detail and a comprehensive understanding of the IRS’s precise requirements. It's not nearly enough to simply incur an expense; you must possess the concrete ability to prove its absolute legitimacy and its undeniable connection to a clearly qualifying category. This unwavering requirement mandates maintaining utterly excellent records, which should include all original receipts, comprehensive veterinary statements, any relevant documentation from medical professionals, or robust, well-organized business records. For service animals, a clear, authoritative letter from a licensed medical doctor unequivocally prescribing the animal for a specific medical condition is absolutely crucial for substantiation. For business animals, robust and verifiable documentation unequivocally demonstrating consistent income generation and the animal's integral, active role within the business operation is simply indispensable. Without this proper, thorough substantiation, even claims that are inherently valid can unfortunately be denied, leading to frustration and lost opportunities. Always, always make it a priority to consult with a qualified tax professional to meticulously discuss your unique and specific situation, as the intricate landscape of tax laws can be incredibly complex and is perpetually evolving over time, ensuring you are consistently making the most informed, advantageous decisions when considering the IRS and pets.

What Others Are Asking About IRS and Pets?

Can I deduct vet bills for my regular house pet with the IRS?

You generally cannot deduct vet bills or other routine expenses for a regular house pet, as the IRS classifies these as non-deductible personal expenses. Deductions are typically reserved for service animals or those integral to income-generating businesses, requiring specific documentation to qualify with the IRS.

Are emotional support animals (ESAs) tax deductible under IRS rules?

Emotional support animals (ESAs) are not typically tax deductible by the IRS. While they offer significant comfort and companionship, they generally do not meet the strict criteria of performing specific, trained tasks to mitigate a disability as defined for service animals and their IRS status.

What documentation is essential for an IRS service animal deduction?

For a service animal deduction, a crucial document is a letter from a licensed medical professional prescribing the animal for a specific medical condition. You also must meticulously keep all receipts for related expenses, including purchase, specialized training, food, and necessary veterinary care for IRS and pets documentation.

Can I deduct pet adoption fees on my taxes?

No, pet adoption fees for a standard companion animal are not typically tax deductible as personal expenses. However, if you are fostering an animal through a qualified 501(c)(3) charity, certain unreimbursed expenses might qualify as charitable contributions to the IRS.

Are pet breeding expenses tax deductible by the IRS?

Yes, if you are genuinely operating a pet breeding business with a clear and consistent profit motive, expenses such as specialized food, comprehensive vet care, effective advertising, and essential supplies can be deductible. Always maintain detailed records of all income and expenses to thoroughly substantiate your business activities for the IRS and pets.

Pet-Related Tax Information Table for IRS and Pets

Category,Eligibility,Deductible Expenses,Key RequirementService Animal,Individual with disability prescribed an animal by medical professional,Purchase, specialized training, food, vet care, grooming,Doctor's letter and task-specific training documentationBusiness Animal,Animal integral to a legitimate, income-generating business,Specialized food, vet care, training, supplies, advertising,Clear profit motive and proven business use caseFostering for Charity,Fostering animals for a qualified 501(c)(3) charitable organization,Unreimbursed food, medical supplies, mileage for charity work,Qualified charity status and meticulous expense recordsGeneral Companion Pet,None (considered personal expense),None,No specific tax provision for personal petsEmotional Support Animal,None (unless also a trained, task-performing service animal),None (unless medically prescribed service animal),Does not perform specific tasks to mitigate a disability under IRS definition

FAQ About IRS and Pets

Who is eligible to deduct pet expenses for IRS purposes?

Individuals whose medical doctor prescribes a service animal for a specific condition, or business owners whose animals are actively integral to generating business income, are generally eligible to deduct certain pet-related expenses when considering the IRS and pets.

What specific types of pet expenses does the IRS consider for deductions?

The IRS specifically considers expenses for medically necessary service animals (like medical care, food, and training) and operational costs for business animals (such as vet care, supplies, and advertising) for potential tax deductions, but not typical companion pet costs for IRS and pets.

Why are the majority of companion pet expenses not tax deductible?

The majority of companion pet expenses are not tax deductible primarily because the IRS consistently classifies typical companion animals as personal property, meaning their associated costs are considered personal living expenses, rather than necessary business or medical expenditures for IRS and pets.

How can a pet owner ensure their pet-related deductions are considered legitimate by the IRS?

To ensure legitimacy, a pet owner must diligently maintain meticulous records, including official medical prescriptions for service animals, detailed financial ledgers for working business animals, and all comprehensive receipts for every claimed expense. Consulting a tax professional is highly recommended for IRS and pets claims.

When did the IRS establish guidelines for service animal deductions?

The IRS has recognized and allowed medical expense deductions for service animals for a considerable duration, acknowledging their crucial role as essential medical equipment. While specific guidelines have evolved, the foundational principle of these deductions has remained consistently in place for IRS and pets.

Summary of Key Takeaways for IRS and Pets

Navigating the intricate intersection of 'IRS and pets' can certainly unveil some surprising tax benefits, but only under very specific circumstances. These opportunities primarily revolve around animals performing duties as service animals for individuals with disabilities or those animals actively engaged in legitimate business activities. It's crucial to remember that while the expenses for your everyday companion pet are generally considered personal and non-deductible, understanding the precise nuances of these exceptions is paramount. Always prioritize keeping exceptionally detailed records and seeking expert professional tax advice to ensure complete compliance and to maximize any legitimate deductions you might qualify for. This proactive, informed approach empowers pet owners to make smarter financial decisions while truly honoring the incredible and diverse roles animals play in our lives, whether they are essential medical aids, valuable business assets, or simply cherished family members. Stay informed, stay prepared, and feel confident in your financial choices regarding IRS and pets!

Service animals may qualify for medical expense deductions. Business-related pet expenses can be deductible under specific conditions. General pet care for companion animals is not deductible. Keep meticulous records for all claimed pet expenses. Tax laws regarding pets are generally strict and narrowly defined by the IRS.

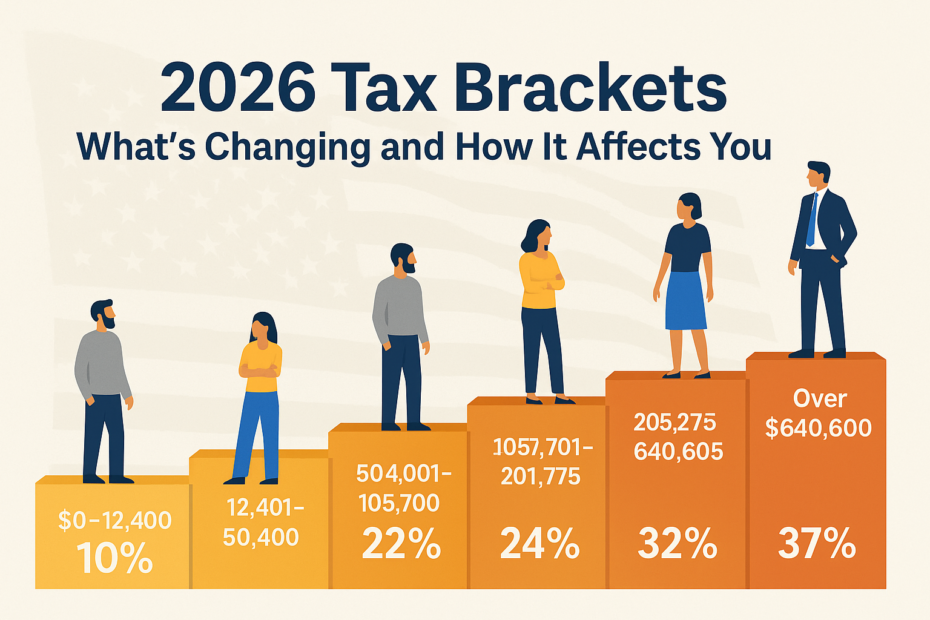

Pet Tax Deductions 2025 And 2026 Tax King Service Pet Tax Deductions 2025.webpIRS Unveils Federal Income Tax Brackets For 2026 How Those Changes IRS 2026 Tax Brackets And Rates Confirmed By The IRS Tax Refunds In 2026 Will Be Higher Thanks To New Irs Taxpayers Refund Benefit 2026

IRS 2025 Tax Forms Unchanged 2026 Updates Preview IRS Keeps 2025 Reporting Rules Same Prepares For 2026 Form Changes IRS Announces 2026 HSA Limits NueSynergy Screenshot 2025 05 05 154048 IRS Announces 2026 Benefit Limits World Insurance IRS Announces 2026 Benefit Limits 1024x576 561x321 IRS Releases Draft 2026 Form W 4 Doeren Mayhew IRS Draft W 4 2026 Changes NEW

IRS RELEASES 2026 LIMITS For HSAs HDHPs And EBHRAs Advan IRS 2026 Irs Tax Rates Blog082823 1024x992 2026 Pets Square Wall Calendar 1 Bc2269a7 1f0b 40b5 A2c9 2026 IRS Inflation Adjusted Numbers Reference Guide For Estate Planning 2026 Wealth Transfer Numbers 1 1200x600

IRS 2026 Federal Income Tax Brackets Complete Guide To The New IRS 2026 Federal Income Tax Brackets 300x169 1 Printable Pet Planner 2026 Designs Graphics 2026 Printable Pet Care Planner Canva Graphics 126365032 1 580x386 IRS Announces 2026 Retirement Plan Limitations CAPTRUST 2026 IRS Limits Numbers Updated V1 1024x549 IRS Releases Draft 2026 Form W 4 Doeren Mayhew

2026 Tax Brackets What S Changing And How It Affects You DAVRON 2026 Tax Brackets 930x620 The IRS Just Announced 2026 Tax Changes Money Guy 2026 Retirement Limits Scaled IRS Announces 2026 Retirement Plan Limits Ollis Akers Arney Insurance IRS Announces 2026 Retirement Plan Limits IRS Announces Major 2026 Tax Season Changes New Senior Deduction IRS Announces Major 2026 Tax Season

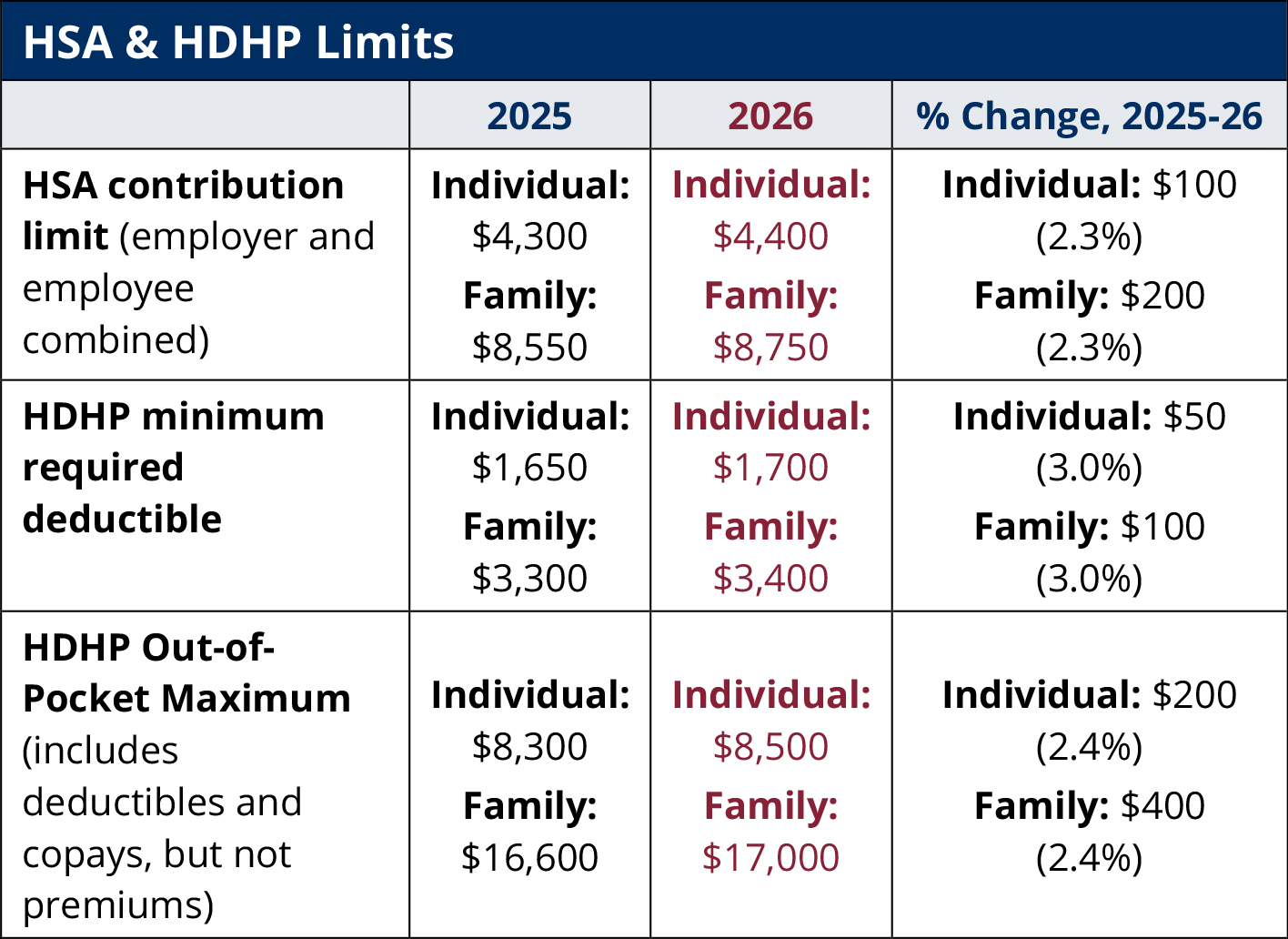

IRS 2026 Changes More Relief And Bigger Deductions For Seniors Full Irs 2026IRS Announces 2026 HSA And HDHP Limits MedBen 2026HSA HDHPLimits 2026 IRS Tax Return Schedule Everything You Need To Know Image IRS Get A Form 1040 2026 2025 Tax Forms Irs Tax Bracket Changes For 2025 Here S What To Know

IRS Accepting Applicants For 2026 Compliance Assurance Process CPA IRS Website IRS Per Diem Rates For 2026 What Changed Engine IRS PER DIEM 2026 2025 IRS Tax Refund Calendar And Schedule 2026 Updated2026 Limits Announced For Health Savings Accounts The Insurance People 2025 Inflation Adjustments Blog Square

IRS Releases 2026 HSA Limits P A Group 2026 HSA Limits Blog Article 1024x1024 IRS Released 2026 Limits For FSAs Commuter Benefits And More IRS 2026 IRS Updates 1220 And 1187 What Financial 2026 Tax Filing Season Key Dates Refund Schedule And New IRS Rules New In 2026 What The IRS Inflation Adjustments Mean For Your Small 2026 IRS Inflation Adjustments For Small Businesses 1024x576

BBP Admin Meet A Vendor Shortlister IRS Increases For 2026 Pets N Poses 2026 Calendar Contest Central Alberta Humane Society CCPnP