Navigating the complex world of insurance often feels overwhelming, leaving many wondering if their policies truly offer optimal coverage and value. This article dives deep into the concept of "fix insurance," guiding you through proactive steps to audit, adjust, and ultimately enhance your personal and business protection plans. Discover essential strategies to identify common pitfalls, negotiate favorable terms, and leverage modern tools to ensure your insurance portfolio aligns perfectly with your evolving needs and financial goals. From understanding policy jargon to securing better rates, we empower you to take control. Learn how to address outdated coverage, eliminate unnecessary expenses, and fortify your financial future against unexpected events. This comprehensive guide helps you secure peace of mind and maximize your insurance investment.

H1 The Ultimate Guide to Fix Insurance and Secure Your FutureP Are you feeling that your insurance policies are not quite right? Many people find themselves in a similar situation, asking how to fix insurance problems. Fixing insurance involves a comprehensive review of your existing policies, identifying gaps, eliminating redundancies, and ensuring you have adequate, cost-effective coverage that truly protects what matters most. It's about optimizing your financial safety net against life's uncertainties. It helps you save money and gain peace of mind by having the right protection in place, ensuring you're ready for 2026 and beyond.H2 Understanding Why We Need to Fix InsuranceH3 The Current State of Insurance ChallengesP The insurance landscape is constantly evolving, presenting new challenges for policyholders. Premiums often increase without clear justification, and coverage options can become outdated quickly. Many individuals struggle with confusing policy language, making it difficult to assess their actual protection. This leads to concerns about how to fix insurance issues before they escalate.H3 Identifying Gaps in Your CoverageP It is crucial to recognize potential weaknesses in your current insurance setup. Perhaps your home insurance does not cover specific natural disasters common in your area, or your auto policy has insufficient liability limits. These overlooked areas are critical to address when you aim to fix insurance effectively. A thorough review often uncovers these vital missing pieces.H2 Strategies to Fix Insurance IssuesH3 Reviewing and Updating Your PoliciesP Regularly examining your insurance policies is fundamental to ensuring they remain relevant and sufficient. Life changes, such as new assets, family additions, or career shifts, demand adjustments to your coverage. Schedule annual check-ups to fix insurance alignment with your current circumstances. This proactive approach prevents future surprises and keeps you adequately protected.H3 Negotiating Better Rates and TermsP Do not hesitate to engage with your insurance providers to discuss your policy rates and terms. Many insurers are open to negotiation, especially if you have a clean claims history or are willing to bundle multiple policies. Research competitor offerings to strengthen your position when you try to fix insurance costs. A little effort can lead to significant savings.H3 Leveraging Technology to Optimize InsuranceP Modern technology offers powerful tools to help you manage and fix insurance. Online comparison platforms allow you to quickly compare quotes from various providers, while digital policy management systems simplify oversight. Utilize apps and digital resources to stay informed about market trends and opportunities to fine-tune your coverage. Technology makes it easier to keep your protection current.H3 Seeking Professional GuidanceP Sometimes, the best way to fix insurance is to enlist the help of an independent insurance advisor. These professionals offer unbiased advice, help you understand complex policies, and identify the best options tailored to your needs. Their expertise can be invaluable in navigating the intricacies of the insurance market. They ensure you make informed decisions for your financial security.H2 What Others Are Asking About Fixing InsuranceH3 How can I lower my car insurance premiums?P To lower car insurance premiums, compare quotes annually from various providers and consider increasing your deductible. Look into bundling policies, asking about discounts for safe driving or low mileage, and improving your credit score. These actions often lead to substantial savings.H3 What steps should I take if my insurance claim is denied?P If your insurance claim is denied, first understand the reason for denial by requesting it in writing. Gather all relevant documentation, appeal the decision with your insurer, and consider seeking help from your state's insurance department or a legal professional. Persistence is key to resolving claim issues.H3 Is it possible to challenge an insurance policy rate increase?P Yes, you can challenge an insurance policy rate increase by contacting your insurer to understand the reasons. Provide any updated information that might qualify you for lower rates, compare quotes from other companies, and inquire about available discounts. Don't simply accept the increase.H3 When is the best time to review my home insurance?P The best time to review your home insurance is annually, especially before renewal. Also, review it after significant life events like home renovations, property value changes, or major purchases to ensure your coverage remains adequate. Regular reviews protect your investment.H3 What are common mistakes to avoid when buying new insurance?P Avoid common mistakes when buying new insurance by not underinsuring your assets, failing to compare multiple quotes, overlooking policy exclusions, and not fully understanding your deductibles. Ensure you accurately disclose all necessary information to prevent future claim issues.H2 FAQ About Fixing InsuranceH3 Who needs to fix insurance?P Anyone with existing insurance policies or those planning to purchase new ones can benefit from fixing insurance. This includes individuals, families, and businesses looking to optimize coverage, reduce costs, or ensure their protection is current and effective. Everyone can gain from smart insurance management.H3 What does 'fix insurance' truly mean?P 'Fix insurance' means actively assessing, adjusting, and improving your insurance policies to better suit your current life circumstances, financial goals, and risk profile. It involves optimizing coverage, securing competitive rates, and ensuring policies are robust against potential future events. It is about smart, proactive management.H3 Why is it important to fix insurance proactively?P Proactively fixing insurance helps prevent financial hardship from inadequate coverage or excessive costs. It ensures your assets are properly protected, reduces unnecessary expenses, and provides peace of mind. Staying ahead of policy changes safeguards your future against unexpected challenges.H3 How can I start to fix my insurance today?P You can start fixing your insurance today by gathering all your current policy documents. Review your coverage amounts, deductibles, and premiums. Then, contact your insurance provider to discuss potential adjustments or seek quotes from competing insurers to compare offerings. Taking the first step is easy.H2 Key Insights to Fix InsuranceP Understanding your policies, comparing options, and adjusting your coverage are vital steps. Leveraging technology simplifies this process, making it easier to manage your protection. Remember, proactive engagement with your insurance means you are always prepared.P Important Steps to Fix InsuranceStep Action Benefit1. Policy Audit Review all existing policies annually. Identifies gaps and redundancies.2. Compare Quotes Obtain multiple quotes from different providers. Secures competitive rates.3. Adjust Coverage Update limits and add endorsements as needed. Ensures adequate protection for evolving needs.4. Negotiate Engage with current insurer for better terms. Can lead to premium reductions.5. Use Technology Utilize online tools and apps. Streamlines management and comparison.6. Seek Advice Consult an independent agent. Provides expert, unbiased guidance.H2 Summary of How to Fix Insurance EffectivelyP Fixing your insurance is an ongoing, empowering process. It involves diligent review, strategic negotiation, and smart utilization of available resources. By taking control, you transform insurance from a passive expense into an active, protective asset. Start today to ensure your financial well-being is robustly safeguarded. Remember, a well-tuned insurance portfolio provides invaluable security. Protecting yourself from unforeseen circumstances gives you ultimate peace of mind. By consistently evaluating your needs and market offerings, you maintain optimal coverage without overspending. This proactive approach to insurance management empowers you to face the future with confidence, knowing you are financially prepared for whatever comes your way. This is how you truly fix insurance for long-term benefit.Optimizing insurance coverage, Reducing premium costs, Understanding policy terms, Proactive insurance management, Leveraging technology for insurance, Identifying coverage gaps, Negotiating insurance rates, Regular policy reviews, Financial protection strategies, Personal insurance improvement, Business insurance optimization, Streamlining insurance processes, Preventing insurance claim denials, Enhancing insurance value, Comprehensive insurance audit.

Global Conference On Infectious Diseases 2026 Pediatric Infections Pramod Kumar Mehta Viralvideos Pramod Kumar Kumar Facebook MediaPramod Kumar The New CEO Of The Barclays India Unit Bffd0dcf 3dae 4672 A4a8

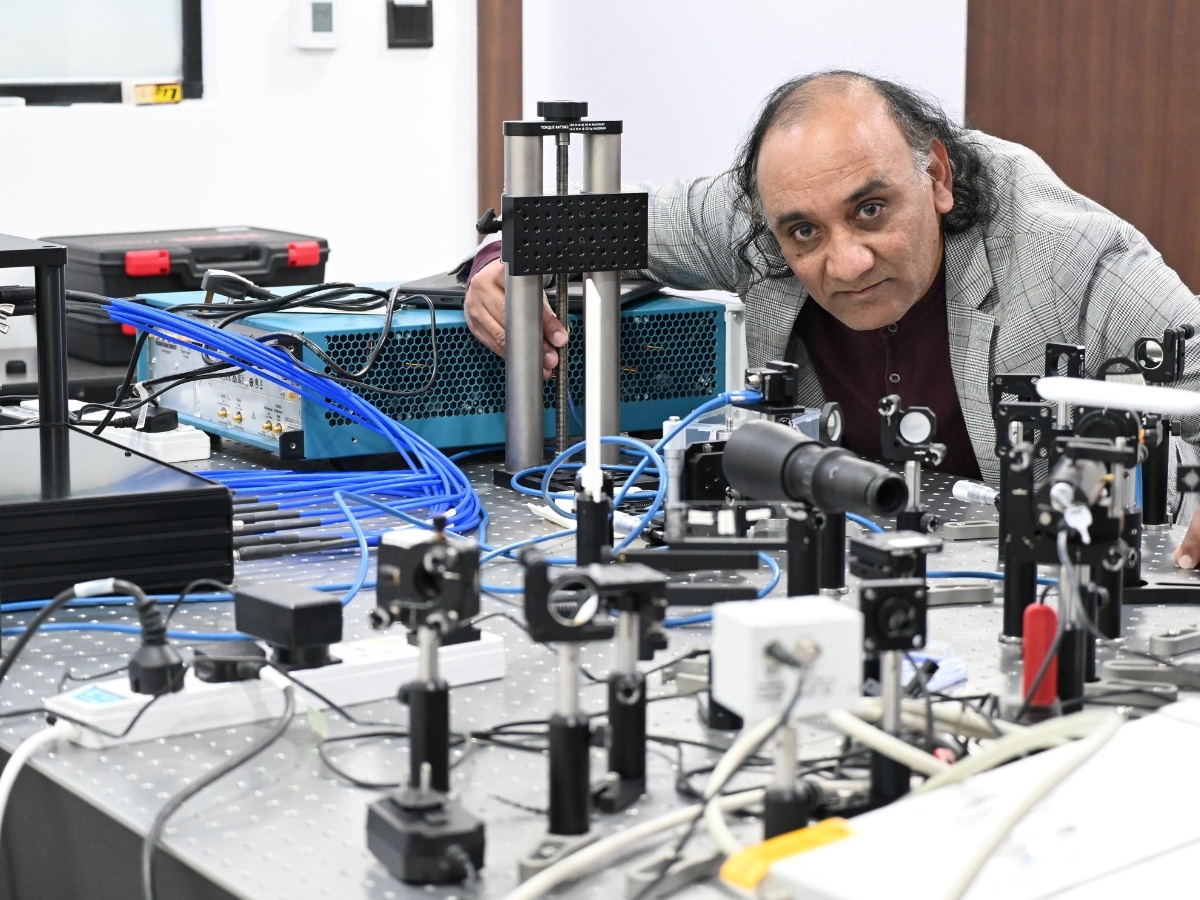

Pramod Kumar MediaDr Pramod Kumar The Quantum Seeker Powering The Next Generation Of AI 2 2026 01 IC3C2026 Conference On Cybernetics Control Pramod Pramod Kumar Pandey

Pramod Kumar Pramod Kumar Nm Large We Didn T Expect This From Spring Boot JVM By Pramod Kumar Jan 1*nn 2Q We Didn T Expect This From Spring Boot JVM By Pramod Kumar Jan IA We Didn T Expect This From Spring Boot JVM By Pramod Kumar Jan Fo5w

ICE Pharma Our Management Team PRAMOD KUMAR Scaled Dr Pramod Kumar Yadav Pramod Kumar Pandey Banaras Lit Fest Speakers ISBM Media Dr Pramod Kumar

Poze Pramod Kumar Actor Poza 6 Din 9 CineMagia Ro Pramod Kumar 153078l 2026 LiveLaw SC 97 CAPTAIN PRAMOD KUMAR BAJAJ VERSUS UNION OF INDIA 648514 Supreme Court Of India Sc 9 Leadership Success Story Of Pramod Kumar Voola S GenAI Vision Project 14 Pramod Kumar Sharma Top Chess Players Chess Com Pramod Kumar Sharma

Top MBA PGDM College In Pune ISB M Pramod Kumar Pramod Kumar Singh Added A New Photo Pramod Kumar Singh MediaPramod KUMAR Researcher PhD IIT Delhi Laboratoire Des Sciences Pramod Kumar 65 500 Palsa Ka Pathashal Ma Chhatara Ka Satha Dasapa Paramatha Kamara

Dr Pramod Kumar The Quantum Seeker Powering The Next Generation Of AI Dr Pramod Kumar1 2026 01 Pramod Kumar Ram Singheshwar Sc Candidate Bihar Election Bio Pramod Kumar MediaIndia Will Continue To See More Inbound And Domestic Interest Pramod Pramod Kumar

2 BIS DG Highlights Importance Of Quality Control In Indian Footwear 355125072 N 299963 AAP Poised To Replace Congress And Out Compete BJP Prof Pramod Kumar 65 Pramod Kumar Pramod Kumar A Scientist And Pramod Kumar 01

Captain Pramod Kumar Bajaj V Union Of India 2026 INSC 101 Public Image 95 The 10 Most Iconic Business Leaders To Follow In Asia 2024 Pramod Kumar Cover Page 01 Scaled We Didn T Expect This From Spring Boot JVM By Pramod Kumar Jan 1*XRxZG09 Our Teams Com Pramod Ji 1333x1333 1 1