Sovernture insurance represents a groundbreaking approach to protecting innovative ventures in an ever-evolving market landscape. This specialized coverage addresses unique risks faced by startups and growth-stage companies navigating uncharted territories. It shields against unforeseen challenges like rapid technological disruption, fluctuating market demands, and emerging regulatory hurdles, ensuring business continuity. Entrepreneurs are increasingly seeking comprehensive solutions beyond traditional policies. Understanding soventure insurance can empower founders and investors, safeguarding their significant investments and pioneering efforts. It offers peace of mind, allowing creative teams to focus on innovation rather than potential catastrophic setbacks. This trending topic signifies a critical shift in risk management for the future of business and will be pivotal in 2026.

Sovernture insurance is a forward-thinking protection designed for dynamic enterprises and pioneering projects navigating complex modern markets. It addresses specific risks faced by startups, innovators, and anyone embarking on ventures with high growth potential yet significant uncertainties. This specialized coverage offers financial stability when traditional insurance falls short. It aims to cushion the impact of unforeseen challenges, from market shifts to technological disruptions, allowing innovators to proceed with confidence. Understanding soventure insurance is crucial for safeguarding the future of ambitious undertakings in 2026.

Understanding Soventure Insurance What It Means For You

Sovernture insurance emerges as a vital safety net for businesses pushing boundaries, especially within technology and high-growth sectors. This specialized policy protects against unique perils that traditional insurance models often overlook or cannot adequately cover. It extends beyond standard property or liability, focusing on the core uncertainties inherent in groundbreaking ventures. Companies embracing innovation find this coverage indispensable for maintaining operational resilience and financial security. It helps to mitigate the inherent risks of exploring new markets and developing cutting-edge solutions.

This innovative insurance product recognizes the rapid pace of change influencing contemporary business environments. It offers tailored protection for intellectual property, market entry failures, and unforeseen regulatory changes impacting novel products or services. Businesses can secure their significant investments against events like rapid obsolescence or sudden shifts in consumer demand. Adopting soventure insurance demonstrates foresight and a commitment to robust risk management strategies for complex projects. It empowers leaders to make bolder decisions with greater confidence in their long-term stability.

Why Soventure Insurance Is Essential For Modern Ventures

In today's fast-paced global economy, where innovation drives progress, soventure insurance provides a crucial layer of security for ambitious projects. Traditional insurance policies often fall short when addressing the unpredictable nature of new technologies, volatile markets, and evolving business models. This specialized coverage becomes indispensable for companies operating at the edge of innovation, safeguarding their future. It helps prevent catastrophic financial losses that could derail groundbreaking initiatives and valuable entrepreneurial efforts.

The landscape of venture capital and startup ecosystems is inherently risky, making targeted protection vital for sustainable growth. Soventure insurance shields against risks like intellectual property infringement in emerging digital spaces or rapid market adoption failures for novel products. It ensures that innovative companies can recover from unexpected setbacks, maintaining their competitive edge and ability to innovate. Investing in soventure insurance signals a proactive approach to risk management, attracting further investment and fostering greater stability.

Key Benefits of Soventure Insurance For Your Future

Embracing soventure insurance brings multiple advantages, solidifying the foundation for sustained growth and innovation within your organization. One primary benefit is comprehensive financial protection against the inherent unpredictability of pioneering ventures and dynamic market conditions. This coverage acts as a buffer, absorbing unexpected costs arising from technological obsolescence or market shifts that could otherwise devastate a project. It safeguards your hard-earned capital and future investment prospects effectively.

Another significant benefit involves enhanced investor confidence, as robust risk mitigation strategies make a venture more attractive to potential backers. Demonstrating a proactive approach to managing complex risks through soventure insurance reassures stakeholders about your project's longevity. It also fosters a culture of innovation, allowing teams to take calculated risks without the paralyzing fear of complete failure. Ultimately, soventure insurance provides strategic stability, empowering ventures to thrive amidst uncertainty and secure their ambitious goals.

How Soventure Insurance Protects Your Investments

Sovernture insurance is meticulously designed to protect the significant financial and intellectual investments central to any forward-thinking enterprise. It provides specific coverage for risks unique to innovative projects, such as potential losses from product development failures or unforeseen legal challenges in new markets. This specialized policy ensures that extensive research, development, and marketing efforts are not undermined by sudden, uninsurable events. It offers a critical safety net, preserving the value of your strategic assets.

Consider the scenario where a novel technology faces unexpected regulatory hurdles or a critical patent dispute emerges, threatening your core business model. Soventure insurance can cover legal defense costs, potential damages, or even lost revenue due to such disruptions. It provides peace of mind, knowing that your capital is shielded from the volatile elements inherent in high-stakes ventures. This protection allows businesses to recover swiftly and continue their mission, transforming challenges into manageable setbacks rather than insurmountable obstacles.

| Aspect | Details of Soventure Insurance |

| Purpose | Protects innovative ventures from unique and evolving risks |

| Coverage Areas | Market volatility, tech disruption, IP risks, regulatory shifts, project failures |

| Target Audience | Startups, tech companies, growth-stage businesses, R&D projects |

| Key Benefit | Financial stability, enhanced investor confidence, business continuity |

| Future Trend | Becoming essential for modern, agile enterprises |

What Others Are Asking?

What specific risks does soventure insurance cover that traditional insurance does not?

Sovernture insurance offers protection against a range of modern risks often excluded by conventional policies. These include financial losses from rapid technological obsolescence, unforeseen market shifts affecting new product adoption, intellectual property disputes in emerging digital spaces, or regulatory changes specifically impacting innovative business models. It also covers project-specific risks, like delays or failures in groundbreaking research and development initiatives, providing comprehensive security for novel ventures.

How does soventure insurance benefit startups and tech companies in 2026?

For startups and tech companies in 2026, soventure insurance provides critical financial stability against the volatile nature of innovation. It safeguards significant investments in R&D and market entry, allowing these agile firms to recover from unexpected setbacks like product launch failures or sudden competitive disruptions. This coverage also enhances investor confidence, making the venture more attractive by demonstrating robust risk management strategies and a commitment to long-term sustainability and growth.

Is soventure insurance mandatory for certain industries or venture types?

While not yet universally mandatory, soventure insurance is rapidly becoming an indispensable safeguard, especially in high-risk, high-reward sectors such as biotechnology, artificial intelligence, and deep tech. As regulatory frameworks evolve to keep pace with innovation, certain venture types involving sensitive data or critical infrastructure may eventually see it become a standard or even required form of protection. Forward-thinking companies are adopting it proactively to secure their ambitious projects.

What factors influence the cost of soventure insurance policies?

The cost of soventure insurance policies is influenced by several key factors. These include the venture's industry and inherent risk profile, the specific scope of coverage required, and the project's overall size and financial investment. The company's track record, the maturity of its technology, and its existing risk mitigation strategies also play a significant role in determining premiums. Policies are highly customizable, reflecting the unique nature of each innovative undertaking.

Can soventure insurance adapt to rapidly changing technological landscapes?

Yes, soventure insurance is inherently designed to be flexible and adaptable, specifically addressing the rapid evolution of technological landscapes. Insurers offering these policies continuously monitor emerging technologies and market trends to update coverage options and risk assessments. Policies often include clauses for dynamic adjustments, ensuring that protection remains relevant even as a venture pivots or encounters unforeseen technological disruptions. This adaptability is central to its value proposition.

FAQ About Soventure Insurance

Who needs Soventure Insurance?

Startups, tech innovators, and growth-stage companies undertaking unique projects benefit most. Anyone investing significantly in new technologies or uncharted market territories should consider soventure insurance for comprehensive protection. It is ideal for ventures facing unpredictable challenges.

What does Soventure Insurance cover?

It covers unique risks beyond traditional policies, including market volatility, technology obsolescence, intellectual property challenges, and regulatory shifts. This specialized insurance protects against financial losses stemming from the inherent uncertainties of innovation and venture development.

Why is Soventure Insurance important now?

With rapid technological advancements and dynamic global markets, businesses face unprecedented risks. Soventure insurance provides essential security, ensuring ventures can recover from setbacks and continue innovating. It’s crucial for maintaining stability in 2026's complex business environment.

How do I get Soventure Insurance?

You typically work with specialized insurance brokers or providers experienced in venture-specific risks. They will assess your project's unique profile, coverage needs, and risk exposure to tailor a suitable policy. Customization is key to effective soventure insurance.

Understanding and adopting soventure insurance is a strategic imperative for any entity venturing into the future of business and innovation. It provides essential financial security and peace of mind in an increasingly unpredictable world. This specialized coverage empowers entrepreneurs to pursue groundbreaking ideas with renewed confidence. By mitigating the unique risks of pioneering ventures, soventure insurance ensures long-term sustainability and encourages continued growth. Explore your options for this vital protection today and secure your ambitious future.

Related blogs- Buy Temporary Hotspot Your Guide to Instant Internet Access

- Norton for iPhones Is It Worth It Your Top Questions

- Sula Game: Unlocking Its Secrets and Thrills

- Apple Camera Scanner How Does It Boost Productivity

- American Mortgage Login: Quick Access to Your Account?

Tailored protection for innovative ventures. Covers market volatility and tech disruption. Safeguards intellectual property risks. Essential for startups and growth companies. Provides business continuity assurance. Evolving risk management solution for 2026.

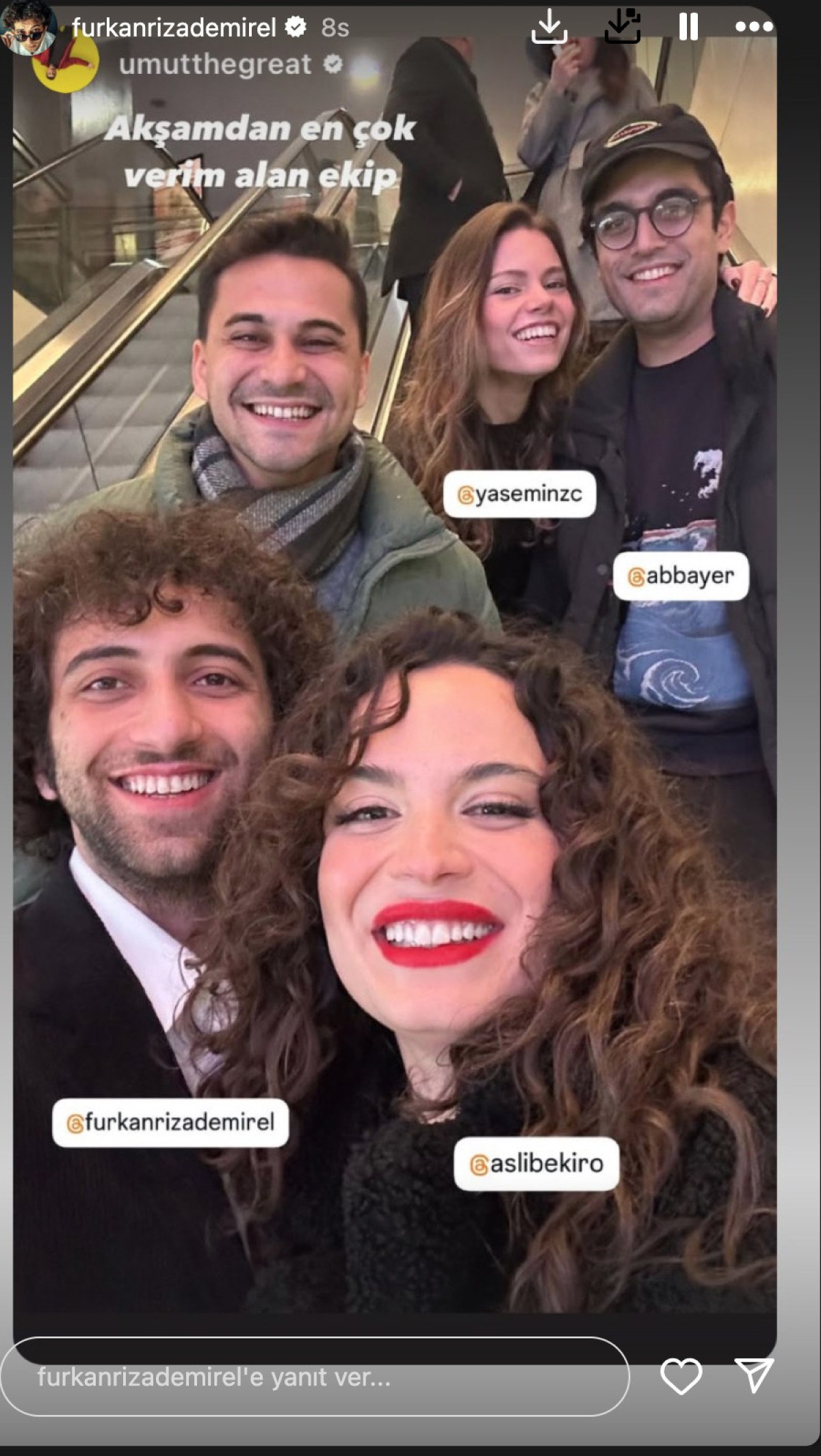

Furkan R Demirel S Profile Letterboxd Avtr 0 1000 0 1000 Crop Furkan R Za Demirel Kimdir Ka Ya Nda Ve Nereli Asl Bekiro Lu Ile 094848336 Furkan Riza Demirel Asl Bekiro Lu Ile Ayr Lan Furkan R Za Demirel Den Ilk A Klama N Life 1

Asl Bekiro Lu Ile Furkan R Za Demirel A K Bitti Habertermo Asli Bekiroglu Ile Furkan Riza Demirel Ayrildi Asl Bekiro Lu Ile Ayr Lan Furkan R Za Demirel Den Ilk A Klama TGRT Asli Bekiroglu Ile Ayrilan Furkan Riza Demirelden Ilk Aciklama 3213081 A K N Y Z 2025 The Movie Database TMDB Asl Bekiro Lu Nun Yeni Sevgilisi Nci Taneleri Dizisinden Furkan R Za W1200xh2128

Asl Bekiro Lu Ile Furkan R Za Demirel Ayr Ld Magazin Haberleri 3781421 Zzet Dikkat Ekti Furkan R Za Demirel Kimdir Urfa Izzet Dikkat Cekti Furkan Riza Demirel Kimdir.webpY L N A K Bombas Asl Bekiro Lu Galaya Sevgilisi Furkan R Za DemirelAsl Bekiro Lu Nun Sevgilisi Furkan R Za Demirel Kimdir Ka Ya Nda Haber Gorselleri Fotoshop 2025 04 1024x576

Furkan R Za Demirel Beyazperde Com Nci Taneleri Nin Sevilen Oyuncusu Furkan R Za Demirel Ile A K Ya Ayan S Furkan R Za Demirel Kimdir Ka Ya Nda Ve Nereli Asl Bekiro Lu Ile Kapak Furkan Riza Demirel Kimdir Kac Yasinda Ve Nereli Asli Bekiroglu Ile Iliskisi Ne Zaman Basladi 836343 Asl Bekiro Lu Nun Sevgilisi Furkan R Za Demirel Kimdir Ka Ya Nda Haber Gorselleri Fotoshop 2025 04 1024x576

Asl Bekiro Lu Nun Yeni Sevgilisi Kim Furkan R Za Demirel Kimdir Ka Asli Yeni Sevgilisi Kim Furkan Riza Demirel Kimdir KacAsl Bekiro Lu Ve Furkan R Za Demirel Nas L Tan T Ankara Masas Asli Bekiroglu Furkan Demirel Ask Yasiyor 16012025 8Furkan R Za Demirel Instagram Photos And Videos Image Furkan R Za Demirel OYUNCU Teaser YouTube

Ber Uns TeleNet Reutte Furkan Demirel 4112a488 Asl Bekiro Lu Ve Furkan R Za Demirel Nas L Tan T Ankara Masas Asli Bekiroglu Furkan Demirel Ask Yasiyor 16012025 9Asl Bekiro Lu Ve Furkan R Za Demirel Ayr Ld Onedio S Furkan Riza Demirel IMDb V1 QL75 UY133

Nci Taneleri Zzet Kimdir Ger Ek Ad Nedir Furkan R Za Demirel Kimdir 12951 Furkan R Demirel On Behance 478518e1 590d 4966 962e Rwc Onur Akbay Nci Taneleri Setinin En Sevimlisi Furkan R Za Demirel Oar2 Kahraman N Sonsuz Yolculu U Furkan R Za Demirel DAR 22 YouTube

Y L N A K Bombas Ortaya Km T Asl Bekiro Lu Ve Furkan R Za Asl Bekiro Lu Ile Furkan R Za Demirel Ayr Ld Magazin Haberleri 3781421