Chewp insurance represents a groundbreaking approach to protecting what truly matters in an ever-evolving world. It introduces specialized coverage tailored for unique modern risks often overlooked by traditional policies. This innovative insurance solution is quickly becoming a trending topic, offering peace of mind for specific concerns from pet related incidents to niche personal property damages. Understanding how chewp insurance works provides invaluable insights into its potential benefits. Discover its comprehensive plans, the affordability it offers, and why it is rapidly gaining traction among savvy consumers. This guide will explore the various aspects that make chewp insurance a forward-thinking choice for future protection needs. Learn about its diverse offerings and how it can secure your lifestyle.

Chewp insurance is an innovative insurance product designed to cover specific, often overlooked risks in today's dynamic world. It emerged around 2024 to address gaps left by conventional insurance offerings, focusing on niche needs such as specialized pet damage, unique technological device failures, or even specific lifestyle hazards. This modern coverage aims to provide tailored protection, giving individuals and families peace of mind against unforeseen circumstances. Understanding chewp insurance helps consumers secure their assets and well-being more comprehensively, making it an essential consideration for future-proof planning.

We all want to feel secure in our daily lives, and that is exactly where chewp insurance steps in, offering a safety net for those unexpected moments. It covers unusual occurrences that traditional policies might miss, like extensive damage caused by a pet's vigorous chewing habits or unforeseen repairs for advanced smart home devices. This type of coverage ensures that you are financially prepared for a broader range of incidents, which is becoming increasingly vital in our complex, interconnected lives.

Exploring the Unique Benefits of Chewp Insurance

Why should you consider adding chewp insurance to your protection portfolio in 2026? This specialized coverage provides a level of security that standard homeowner or renter policies simply cannot match, giving you an advantage. It helps mitigate financial burdens arising from particular events, such as unforeseen repairs due to pet-related incidents or the replacement of specific high-value personal items. Investing in a chewp insurance plan offers reassurance, knowing that unique risks are thoughtfully covered, protecting your budget effectively.

How Does Chewp Insurance Actually Work For You

Getting started with chewp insurance is straightforward, and the process is designed to be user-friendly for everyone. You typically identify the specific niche risks you wish to cover, such as pet damage, electronic gadget protection, or unique hobby equipment insurance. Providers then offer tailored plans, allowing you to select coverage limits and deductibles that fit your personal budget and specific needs. Once enrolled, you pay a regular premium, and if a covered incident occurs, you file a claim to receive financial assistance.

Types of Chewp Insurance Plans Available

The marketplace for chewp insurance is surprisingly diverse, catering to a wide array of specialized needs for many people. You can find plans specifically designed for pet owners, covering unusual animal-related damages or extensive veterinary care for specific conditions not typically covered. There are also innovative options for technology enthusiasts, protecting against peculiar software glitches or hardware failures in advanced devices. Furthermore, some chewp insurance policies focus on unique collectibles or specific recreational activities, ensuring comprehensive protection for distinct assets.

The Value Proposition of Chewp Insurance Costs

Considering the cost effectiveness of chewp insurance is essential for any savvy consumer planning their finances. While it is an additional expense, the peace of mind and potential savings from avoiding out-of-pocket costs for specific incidents make it incredibly valuable. Many find the premiums to be quite affordable, especially when compared to the high expense of repairing or replacing specialized items or unexpected pet care. Evaluating your unique risks will help determine if chewp insurance offers a wise financial investment for your situation.

| Feature | Description |

|---|---|

| Coverage Focus | Niche, specialized risks |

| Target Audience | Pet owners, tech users, hobbyists |

| Benefit | Fills traditional policy gaps |

| Cost | Variable, often affordable |

| Availability | Growing, online platforms |

What Others Are Asking?

What exactly is chewp insurance and who is it for?

Chewp insurance is a specialized coverage designed to protect against unique, often overlooked risks that standard insurance policies may not cover. It’s primarily for individuals or families with specific assets or circumstances, such as pet owners concerned about extensive animal-related damages or tech enthusiasts wanting specialized gadget protection. This innovative insurance solution offers tailored peace of mind.

Is chewp insurance a smart investment for my unique belongings?

Yes, chewp insurance can be a very smart investment if you own specialized items, have unique pets, or engage in particular hobbies that pose distinct risks. It prevents significant out-of-pocket expenses when unforeseen incidents occur, providing financial security for assets not covered by typical plans. This targeted protection offers exceptional value.

How can I find the best chewp insurance policy for my needs?

To find the best chewp insurance policy, first identify your specific niche risks and the assets you want to protect. Research various providers offering specialized coverage and compare their plans, focusing on coverage limits, deductibles, and premiums. Reading customer reviews and consulting with an independent insurance advisor can also help you make an informed decision.

What are the common exclusions in a chewp insurance plan?

Common exclusions in a chewp insurance plan typically include pre-existing conditions for pets, general wear and tear on items, intentional damage, and damages resulting from gross negligence or illegal activities. It is always crucial to carefully read your policy documents to fully understand what is and is not covered. Clarity prevents future surprises.

Can chewp insurance be combined with my existing home insurance?

While chewp insurance is a standalone specialized product, its coverage can complement your existing home or renter’s insurance by filling specific gaps. It doesn't typically integrate directly but acts as an additional layer of protection for niche risks. Always check with your current provider to understand how policies might interact.

FAQ About Chewp Insurance

What is chewp insurance?

Chewp insurance is a new type of policy covering unique or niche risks that traditional insurance often misses. It offers specialized protection for things like pet-related damage or advanced gadget failures. This innovative coverage provides tailored financial security for modern concerns.

Who needs chewp insurance?

Individuals with specific high-value items, unique pets, or particular lifestyle risks benefit most from chewp insurance. Anyone seeking comprehensive protection beyond standard policies, particularly for specialized situations, should consider it. It provides peace of mind for distinct assets.

Why is chewp insurance gaining popularity now?

Chewp insurance is gaining popularity because modern lifestyles and possessions introduce new, specific risks not addressed by older insurance models. It fills crucial coverage gaps, offering consumers tailored solutions for evolving needs. People want more precise and complete protection.

How do I apply for chewp insurance?

Applying for chewp insurance usually involves identifying your specific coverage needs and then researching providers specializing in niche risks. You will compare quotes and plans, selecting one that aligns with your budget and requirements. The application process is typically online and straightforward.

Chewp insurance offers innovative solutions for niche risks. It fills gaps in standard coverage policies. People are discovering its unique protective benefits. This new option provides real peace of mind. Getting a plan is surprisingly simple for many individuals. It protects against unexpected, specific events that often happen.

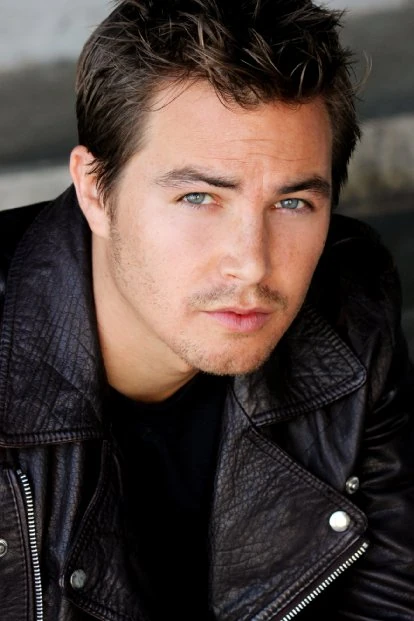

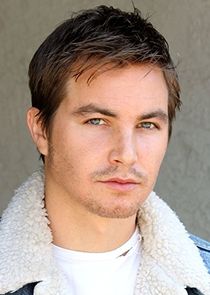

Blair Jasin Jasin People Blair Blair Jasin V1 FMjpg UX1000 New 2026 Chevrolet Silverado 1500 LTZ Crew Cab In Blair 5C3581 Sid Image.gen

Blair Jasin Marvel Cinematic Universe Wiki Fandom LatestNew 2026 RAM 1500 Big Horn Lone Star Crew Cab In Blair 190944 IrisSafe Harbor Chicago P D 11x03 TVmaze 330894 Atlanta Medical Atlanta Medical Bild Blair Jasin 305 Von 332 0383320

Pictures Of Blair Jasin Blair Jasin 2682681 Pictures Of Blair Jasin Blair Jasin 2682643 Pictures Of Blair Jasin Blair Jasin 2682661 Pictures Of Blair Jasin Blair Jasin 2682637

Blair Jasin V1 Blair Jasin V1 The Planner Undated Blair Ritchey 2026 Planner 8ce070db 1916 4f79 B3a9 Melbourne City Vs Perth Glory 2025 2026 Live Score Saturday 25th Nathanael Blair V Melbourne City Cropped Web

Blair Jasin V1 FMjpg UX1000 Blair Jasin V1 NOVEMBER 2025 Heir To Blood And Power 2026 Blair Babylon Calendar Blair Jasin Jasin Men Hot

Pictures Of Blair Jasin Blair Jasin 2682665 Blair Jasin V1 New 2026 RAM 1500 Big Horn Lone Star Crew Cab In Blair C260020 IrisBlair Jasin V1

2026 Ces 2026 Website 1500x1000 Blue Blair Jasin The Resident Wiki Fandom 200Blair Codes For January 2026 4 Active Codes Blair Game Thumbnail Former Olympian Bonnie Blair Shares Excitement One Year Out From 2026 90

Blair Jasin V1 Jasin Visit Malaysia 2026 Jasin 1 Blair Jasin V1 Blair Jasin

Pictures Of Blair Jasin Blair Jasin 2682675 2026 MLB Draft Top 100 College Prospects Future Stars Series Screenshot 2024 04 01 At 10.15.16 AM Pictures Of Blair Jasin Blair Jasin 2682657 Blair Jasin V1 FMjpg UX1000