Business Interruption Insurance, or BIA, offers crucial financial protection for companies facing unexpected disruptions. This vital coverage helps replace lost income and cover ongoing expenses when a business cannot operate due to covered perils. Understanding BIA insurance is essential for proactive risk management, especially with increasing global uncertainties affecting supply chains and operations. Many businesses, from small startups to large corporations, are realizing the irreplaceable value of BIA. It ensures financial stability, allowing recovery after events like natural disasters or equipment failures. This forward-looking guide explores how BIA insurance functions as a cornerstone of modern business resilience and why it is trending as a priority for savvy entrepreneurs in the current economic landscape.

Business Interruption Insurance, often called BIA insurance, is a crucial safeguard for any thriving enterprise. It protects against financial losses that occur when your business operations are temporarily halted. This coverage helps maintain stability and allows you to recover effectively after an unforeseen event. Businesses use BIA insurance to manage risks associated with various disruptions.

Understanding BIA insurance involves knowing who benefits and what it encompasses. This policy steps in when your business experiences physical damage from a covered peril. For example, a fire or a natural disaster might force a temporary closure. The insurance then compensates for the profits you would have earned during that shutdown period. It also covers ongoing operating expenses, such as rent and payroll.

The Growing Importance of BIA Insurance Today

Why are businesses increasingly prioritizing BIA insurance in today's dynamic environment? The modern business landscape presents numerous potential threats to continuous operation. Supply chain disruptions, cyberattacks, and severe weather events are becoming more frequent. Therefore, having robust BIA coverage is no longer just an option but a strategic imperative. It provides peace of mind in an unpredictable world.

How can BIA insurance specifically help your business navigate future challenges? Consider the evolving nature of risks impacting companies across sectors. Cyber incidents, for instance, can render digital operations non-functional for extended periods. BIA insurance adapted for these modern perils offers a critical financial buffer. It empowers businesses to withstand prolonged downtime without catastrophic financial fallout.

Is your current BIA insurance policy truly comprehensive enough for 2026 and beyond? Many businesses are reviewing their policies to ensure they account for emerging threats. This includes evaluating coverage for non-physical damage events like cyber breaches or government-mandated shutdowns. An updated policy reflects a deeper understanding of contemporary business vulnerabilities. It aligns with the need for agile and responsive risk management strategies.

| Purpose | Covers lost income and fixed expenses due to covered disruptions. |

| Coverage Triggers | Physical damage from perils like fire, flood, theft, severe weather. |

| Benefits | Financial stability during downtime, helps retain employees, covers relocation costs. |

| Duration | Typically covers a defined 'period of restoration' until operations resume. |

| Cost Factors | Industry, location, coverage limits, deductible, waiting period. |

What Others Are Asking? About BIA Insurance

What does BIA insurance cover?

BIA insurance typically covers lost net income, continuing operating expenses, and extra expenses incurred to minimize the interruption. This includes rent, payroll, and temporary relocation costs when your business cannot operate due to a covered peril. It ensures financial continuity during a period of restoration, helping businesses recover effectively after significant disruption.

Is business interruption insurance worth it for small businesses?

Absolutely, business interruption insurance is highly valuable for small businesses. They often have tighter margins and less financial cushion to absorb prolonged downtime. This insurance provides a critical safety net, replacing lost revenue and covering ongoing expenses. It ensures the business can reopen and retain employees after an unexpected event, preventing potential collapse.

How much does BIA insurance cost for a typical business?

The cost of BIA insurance varies significantly based on several factors, including the business's industry, location, revenue, and chosen coverage limits. It also depends on the deductible amount and the waiting period before benefits begin. Businesses should obtain tailored quotes to understand their specific premium. Generally, it is a small investment for significant protection.

What is the waiting period for business interruption insurance?

The waiting period for business interruption insurance, also known as a 'time deductible,' is the period after a covered loss before benefits start. This period is typically 24, 48, or 72 hours. Selecting a longer waiting period can often reduce the premium. Businesses must carefully consider their cash flow to choose an appropriate waiting period that aligns with their financial resilience.

Does business interruption insurance cover pandemics?

Historically, most standard BIA insurance policies specifically excluded coverage for losses due to viruses or bacteria, including pandemics. However, after recent global health crises, there's ongoing discussion and some insurers may offer specialized endorsements or policies for such risks. Businesses should thoroughly review their specific policy language and discuss pandemic coverage with their agent.

FAQ About BIA Insurance

What is BIA insurance?

BIA insurance is Business Interruption Insurance, which covers lost income and operating expenses when a business cannot function due to physical damage from a covered event. It helps businesses recover financially by providing funds during the period of restoration. This essential coverage ensures continuity.

Who needs BIA insurance?

Any business, regardless of size, that relies on physical premises or specific equipment to generate revenue can benefit from BIA insurance. It is particularly crucial for businesses that would face significant financial hardship if forced to close temporarily. This includes retailers, manufacturers, and service providers.

Why is BIA insurance important for business resilience?

BIA insurance is vital because it provides the financial resources necessary to survive and rebuild after a major disruption. It prevents permanent closure by covering essential costs and lost profits. This allows businesses to maintain payroll, pay rent, and ultimately resume normal operations.

How does BIA insurance work after a claim?

After a covered event causes physical damage and business interruption, you file a claim with your insurer. The insurer assesses the loss, including lost profits and ongoing expenses, based on your financial records. Once approved, they reimburse you for covered losses during the agreed-upon period of restoration. This process supports your recovery.

Covers lost income and operating expenses after a disruption. Essential for business continuity and financial resilience. Protects against various perils like fire, theft, and natural disasters. Helps businesses recover faster and maintain stability. Customizable to fit specific industry needs and risks. A critical component of a comprehensive commercial insurance strategy.

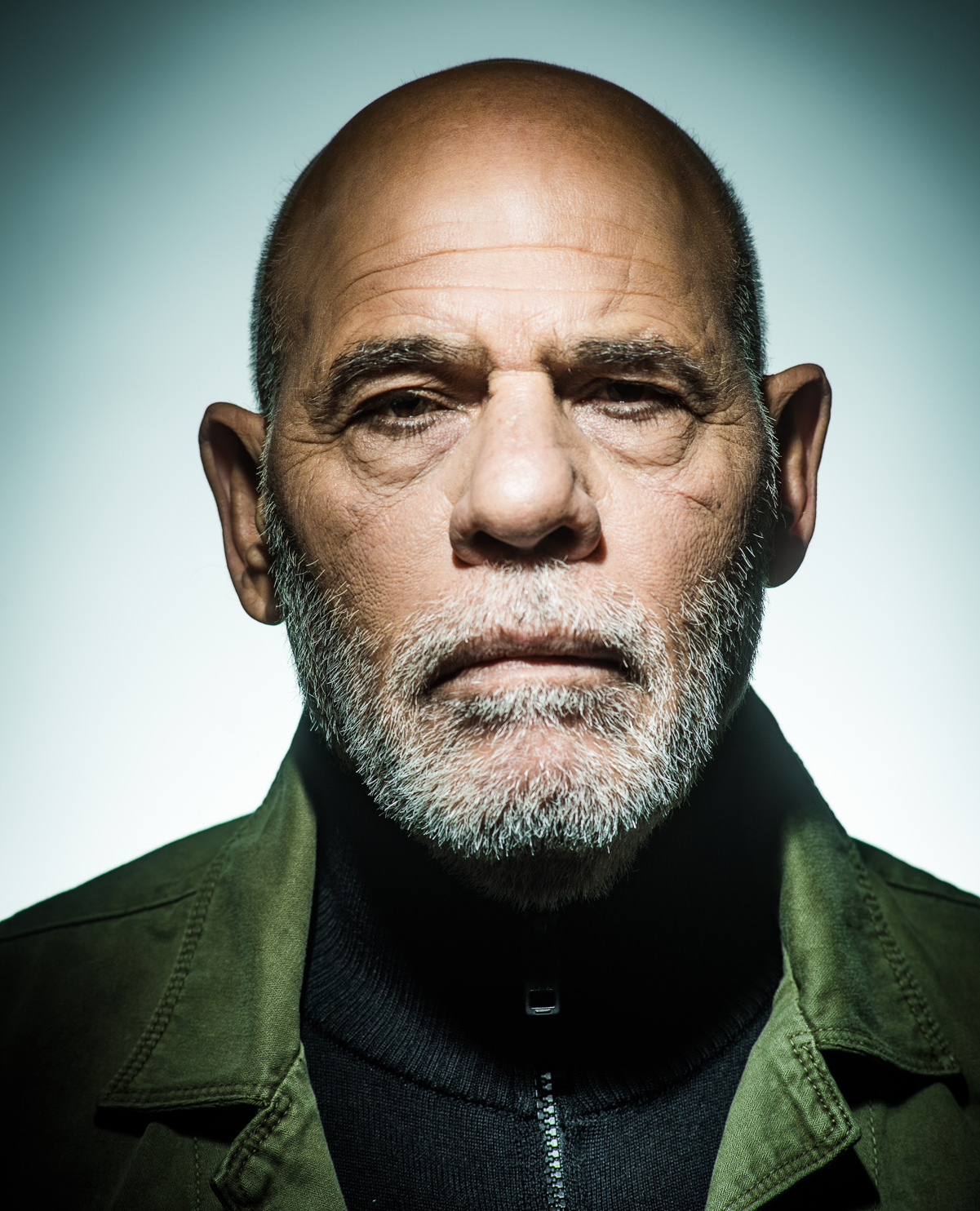

Uri Gavriel Alchetron The Free Social Uri Gavriel 600499ca Fbd1 418b Bddc B9db5c83017 Resize 750 Uri Gavriel Biografia 37343 Ico Ana Arabia Year 2013 Israel Director Amos Gita Uri Gavriel Stock Ana Arabia Year 2013 Israel Director Amos Gita Uri Gavriel R2H8RF

Uri Gavriel V1 FMjpg UX1000 Uri Gavriel Alchetron The Free Social Uri Gavriel 2f21cd9a 8799 410c B4fc 0dccadee0e9 Resize 750 Adar Gold V1 Uri Gavriel SFD Cz 273207 E1a415

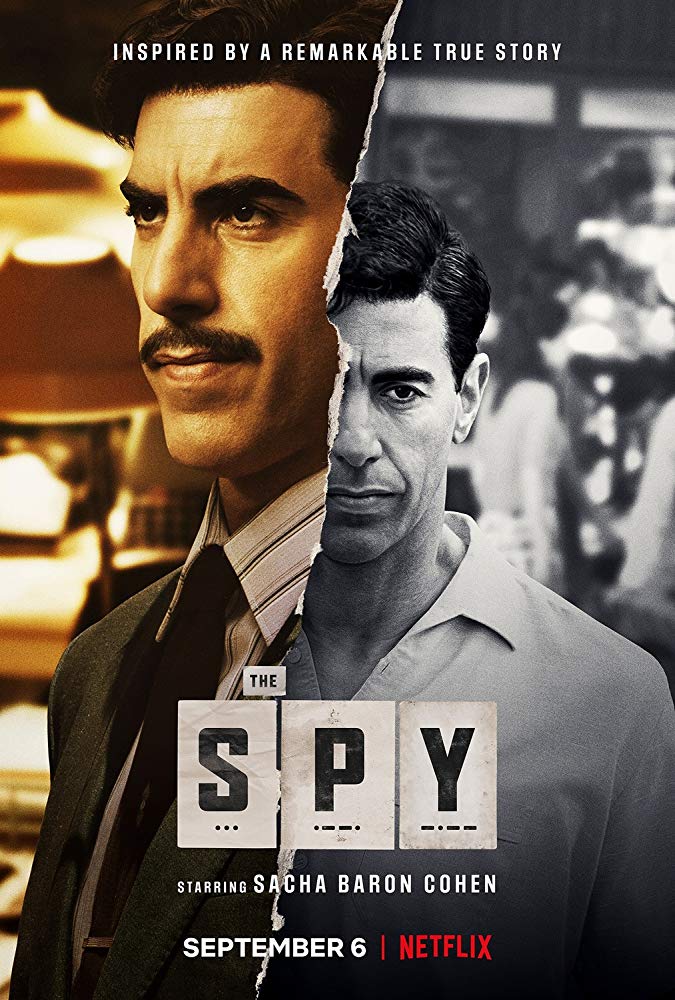

Uri Gavriel Yri Gavriel Twitter R Solution G N Rale 2022 2026 De L URI CFDT Grand Est CFDT E10032c1 C8f9 43e9 905d 1812 942 75.webpUri Gavriel V1 Is The Spy Actor Uri Gavriel Single Or Married Know His Uri Gavriel

Award Winning Actor Let Everyone In Gaza Die Of Hunger Until The 1111110 Uri Gavriel IMDb V1 FMjpg UX1000 The Spy Movie Review Film Summary 2019 Roger Ebert The Spy Uri Gavriel V1

Uri Gavriel Artiste Isra Lien Complet Cin Dweller Uri Gavriel Portrait Uri Gavriel Internet Movie Firearms Database Guns In Movies TV And 600pxURI Vestibular 2026 01 Banner Verao Uri Gavriel T26165 URI GAVRIEL MAIN

WHAT A WONDERFUL PLACE Aka EIZE MAKOM NIFLA Evelyn Kaplun Uri What A Wonderful Place Aka Eize Makom Nifla Evelyn Kaplun Uri Gavriel HCP6H7 The Attack Movie Review Film Summary 2013 Roger Ebert The Attack Jpg.webpUri Gavriel SincroGuia TV Cine 341776 SPA Uri Gavriel V1

THURE LINDHARDT URI GAVRIEL GEMMA ARTERTON SAM RILEY BYZANTIUM Thure Lindhardt Uri Gavriel Gemma Arterton Sam Riley Byzantium 2012 2JJHP9R Uri Gavriel Official Site For Man Crush Monday MCM Woman Crush Uri Gavriel Sexy 0 Ana Arabia Year 2013 Israel Director Amos Gita Uri Gavriel Yuval Ana Arabia Year 2013 Israel Director Amos Gita Uri Gavriel Yuval Scharf R2H8RC Shadow King Fan Casting For X Men Villains Fancast MyCast Fan Actor Uri Gavriel 232717 Large

Uri Gavriel Alchetron The Free Social Uri Gavriel F63af330 D4bf 40e6 89c5 D7fb4bc6da8 Resize 750 Uri Gavriel SFD Cz 157804457 92cc97 Uri Gavriel V1 Uri Gavriel Spouse Children Birthday More Share Image

Uri Gavriel Zohar Yakobson ???? ???1 1 1 Uri Gavriel Alchetron The Free Social Uri Gavriel F2ea5bea D090 4095 985e 01452b5f085 Resize 750 Uri Gavriel Yri Gavriel Twitter Uri Gavriel Zohar Yakobson ???? 1 1